The final keynote has concluded, the exhibition hall is emptying, and the last attendee has departed. But for the savvy event planner, the work is far from over. In fact, some of the most crucial work – the Post-Event Analysis & Aftermath – is just beginning. This isn't just about tidying up loose ends; it's about turning a past experience into a powerful blueprint for future triumphs, transforming data into an invaluable asset for growth and continuous improvement.

Think of it this way: throwing an event without a thorough aftermath strategy is like launching a rocket without a flight recorder. You might know if it hit the moon, but you'll never understand why it did (or didn't). A robust post-event analysis is your flight recorder, meticulously documenting what worked, what didn’t, and—most importantly—why.

At a Glance: Your Aftermath Checklist

- It's a deliberate, structured evaluation. Don't just "think" about how it went; formally assess it.

- Data is your goldmine. Collect both quantitative (numbers) and qualitative (feedback) insights.

- Goals are your compass. Your initial objectives define what you measure and how you interpret success.

- Action is the endgame. Analysis is useless without clear recommendations and next steps for improvement.

- Involve everyone. Stakeholder debriefs ensure a holistic view and shared understanding.

- It's a continuous cycle. Each analysis fuels the planning for your next, even better event.

Why the Aftermath Matters: Beyond the Party Poppers

Many event planners view the event itself as the finish line. In reality, it's just the end of the first lap. The true value and lessons are unlocked in the aftermath. Post-event analysis (PEA) is your systematic deep dive, a structured evaluation designed to assess the event's effectiveness in achieving its goals, to learn critical lessons, to improve future iterations, and to unequivocally prove the value delivered.

Consider the landscape: despite the clear benefits, many in the event industry are still leaving insights on the table. A significant 23% of planners admit they don't measure success at all, while 18% lack the necessary tools, and another 19% struggle to get their hands on the right event data. This gap represents a massive missed opportunity.

By embracing a comprehensive PEA, you move beyond guesswork and gut feelings. You gain the power to:

- Identify successes and weaknesses: Pinpoint what truly resonated with your audience and where the experience fell short.

- Improve future events: Make data-driven decisions that elevate every aspect of your next gathering, from content to catering.

- Enhance attendee satisfaction: Understand what drives a positive experience and replicate those elements consistently.

- Track financial performance and calculate ROI: Justify your budget, demonstrate value to stakeholders, and optimize spending.

- Boost engagement: Uncover which sessions, activities, or formats truly captivate your audience, informing future content strategy.

Without this deliberate reflection, every event essentially starts from scratch, repeating mistakes and missing opportunities for exponential growth.

Decoding Your Event's DNA: The Core Components of Analysis

To truly understand an event's performance, you need to examine it through several critical lenses. These components form the bedrock of your post-event analysis:

- Performance Metrics (The Hard Numbers): This is the quantitative data – the undeniable facts and figures that paint a picture of operational and logistical success. We're talking attendance numbers, session engagement rates, budget adherence, website traffic, and registration conversion rates. These metrics provide objective measures of what happened.

- Feedback (The Human Voice): Beyond the numbers, you need to hear directly from the people involved. This qualitative input comes from attendees, sponsors, exhibitors, staff, and even social media chatter. Feedback offers invaluable context, reveals satisfaction levels, highlights unexpected issues, and pinpoints areas ripe for improvement. It tells you why the numbers are what they are.

- Return on Investment (ROI) (The Value Proposition): At its heart, an event is an investment of time, money, and resources. ROI assesses the value gained relative to what was spent. For organizers, this means financial profits, lead generation, or brand lift. For sponsors, it's about exposure, qualified leads, and brand association. Understanding ROI is critical for demonstrating an event's tangible business impact.

Blueprinting Success: Starting with Clear Goals

Before you even think about data collection, step back. What was your event supposed to achieve? Well-defined goals, established before the event even begins, are your north star for post-event analysis. They act as essential benchmarks, guiding what you measure and how you ultimately evaluate impact. Without clear goals, your data becomes a collection of interesting facts rather than actionable insights.

Consider these critical areas when setting your upfront goals:

- Attendance Targets: How many registrations did you aim for? How many actual check-ins? Did specific demographics attend?

- Engagement Metrics: What level of participation did you expect in sessions, networking activities, or your event app? Were attendees using Q&A features, polls, or connecting with exhibitors?

- Revenue Objectives: Beyond breaking even, did you aim for specific ticket sales, sponsorship revenue, or lead generation quotas?

- Brand Exposure & Awareness: Did you intend to increase brand mentions, website traffic, or media coverage?

- Sustainability Goals: Were there specific targets for waste reduction, energy consumption, or local sourcing?

- Lead Generation & Conversion: How many qualified leads did you hope to generate for your sales team? What was the expected conversion rate?

- Stakeholder Satisfaction: What level of satisfaction did you aim for from attendees, sponsors, speakers, and staff?

By defining these parameters early, you create a measurable framework against which you can objectively compare your post-event data.

The Detective's Toolkit: Purposeful Data Collection

Effective post-event analysis hinges on purposeful data collection. You need to gather both quantitative and qualitative data, and crucially, from all phases of the event (before, during, and after) to ensure a truly comprehensive and nuanced analysis. Don't wait until the event is over to think about data – integrate capture mechanisms from the very beginning.

Essential Data Sources to Tap Into:

- Registration & Attendance: Total registrations, actual check-ins, no-show rates, attendee demographics (job title, industry, location), and registration trends (e.g., early bird vs. last minute).

- Session/Activity Engagement: Attendance at specific sessions, booth visits (if applicable), app usage statistics (profile views, message sends), and participation in interactive elements like polls or Q&As.

- Feedback: Direct input from attendees, sponsors, speakers, and staff via surveys, interviews, and testimonials.

- Social Media & Online Engagement: Hashtag performance, mentions, shares, sentiment around your event, and engagement with your event website or online platforms.

- Financial Reports: Detailed budget adherence, actual vs. projected expenses, sponsorship revenue, ticket sales, and vendor costs.

- Operational & Logistical Metrics: Check-in times, crowd flow in different areas, waiting times for services, and resource utilization (e.g., number of staff required).

- Sustainability Measures: Waste reduction metrics (recycling rates, landfill diversion), energy consumption data, and carbon footprint estimates.

Data Collection Methods: Your Arsenal for Insights

Choosing the right methods is key to capturing rich, relevant data:

- Surveys & Questionnaires: These are your bread and butter. Send them out immediately post-event while the experience is fresh in participants' minds.

- Best Practice: Use online tools like Google Forms, SurveyMonkey, or Typeform. Keep them concise but comprehensive, covering overall satisfaction, session quality, logistics, and what attendees would like to see next. Focus on specific, measurable questions.

- Interviews & Focus Groups: For deeper qualitative insights, particularly the "why" behind opinions.

- Best Practice: Conduct one-on-one interviews with a diverse group of attendees, key stakeholders, or sponsors. Organize small focus groups (5-8 participants) to encourage discussion and uncover shared sentiments or unique perspectives.

- Social Media & Online Monitoring: The digital world never sleeps, and neither should your data collection from it.

- Best Practice: Use social listening tools (Hootsuite, Brandwatch, Sprout Social) to track mentions of your event hashtag, brand, and key speakers. Analyze sentiment (positive, negative, neutral) and identify trending topics or common complaints.

- Ticketing Platform & Registration Data: This often-overlooked source is a treasure trove of quantitative data.

- Best Practice: Dive into your platform data to analyze attendee patterns, demographics, peak registration times, and ticket type preferences. This helps you understand your audience better and optimize future pricing strategies.

- Live Polling: Real-time feedback during sessions offers immediate engagement insights.

- Best Practice: Integrate live polling tools into your presentations or event app to gauge understanding, opinion, or engagement on specific topics. This provides granular feedback on individual content pieces.

- Mobile & Website App Feedback: If your event has an app or dedicated website, leverage its integrated feedback features.

- Best Practice: Offer in-app surveys or comment features for convenience. This allows attendees to provide feedback on specific sessions, speakers, or features while they're still interacting with them, often leading to more immediate and relevant responses.

From Raw Data to Brilliant Insights: Analysis Methods that Transform

Collecting data is only half the battle. The real magic happens when you transform that raw information into meaningful, actionable outcomes. This is where your analytical prowess comes into play.

Explore Performance Trends & Patterns:

Don't just look at isolated numbers; seek out the story they tell over time and in comparison to others.

- Longitudinal Analysis: Track key metrics over time across multiple events. Is attendance consistently growing? Are engagement rates fluctuating?

- Time-Series/Regression Analysis: Dive deeper into longitudinal data to identify growth patterns, plateaus, or declines. Are certain marketing efforts leading to spikes in registration?

- Pattern Recognition & Anomaly Detection: Look for outliers – unusually high or low engagement for a session, unexpected budget overruns. Understanding these anomalies can reveal critical insights or hidden problems.

- Comparative Analysis: Assess your event's performance against past events, industry benchmarks, or even competitor events. How did your keynote speaker's rating compare to last year's?

Conduct Satisfaction & Sentiment Analysis:

Understand the emotional resonance and perceived value of your event.

- Aggregate Survey Data: Calculate averages, medians, and modes for quantitative satisfaction questions. Identify the highest and lowest-rated aspects.

- Calculate Net Promoter Score (NPS): A powerful metric to gauge overall loyalty and willingness to recommend. (NPS = % Promoters - % Detractors).

- Thematic Coding & Text/Sentiment Analysis: For open-ended feedback (survey comments, social media), systematically categorize recurring themes (e.g., "long lines," "great content," "networking opportunities"). Use AI-powered text analysis tools for large volumes of data to quickly identify dominant sentiments.

Calculate ROI for Organizers & Sponsors:

Demonstrate the tangible value generated by your event, justifying its existence and attracting future investment. This goes beyond just ticket sales; it's about the overall business impact. When you truly grasp the financial implications and strategic wins, you begin to Understanding Kai Win or Lose your event's long-term value and where to invest resources for maximum benefit.

- Revenue & Cost Analysis: Meticulously track all revenue streams (ticket sales, sponsorships, exhibitor fees) and compare them against all expenses (venue, speakers, marketing, staff). Calculate gross revenue, total expenses, and net profit.

- ROI Computation: The classic formula:

(Net Gain / Total Investment) * 100%. Ensure you define "Net Gain" (e.g., profit, value of leads generated) and "Total Investment" comprehensively. - Sponsor Value: For sponsors, track direct benefits like brand exposure (impressions, mentions), leads generated at their booth or via event app, and conversions resulting from their participation. Also consider indirect benefits like increased brand perception or long-term partnership value.

Track Lead Generation & Conversion:

For events focused on business development, this analysis is paramount.

- Funnel Analysis: Map the attendee journey from initial awareness and registration, through engagement at the event, to post-event follow-up. Identify drop-off points and calculate conversion rates at each stage.

- Lead Quality Assessment: Segment generated leads by engagement level, demographics, intent, and fit with your ideal customer profile. Are you attracting the right people?

- Source Attribution: Determine which marketing channels (social media, email, partnerships) were most effective in generating registrations and qualified leads.

Identify Most & Least Effective Elements:

Pinpoint the stars and the duds of your event program.

- Session-Level Analysis: Combine attendance data, engagement metrics (Q&A participation, poll responses), session ratings from surveys, and qualitative feedback to identify top-performing and underperforming sessions or speakers.

- Promotional Channel Analysis: Look at conversion rates and engagement for different marketing efforts. Did your LinkedIn ads perform better than your email campaign?

Correlate Feedback with Attendance & Engagement:

Dig into the relationships between what people said and what they did.

- Cross-Tabulation: Match satisfaction scores with demographics, participation levels, or specific engagement activities. For instance, are first-time attendees more or less satisfied than returning ones?

- Segmentation Analysis: Identify group-specific satisfaction or engagement patterns. Did your VIP attendees have a different experience or feedback than general admission?

- Behavior-Feedback Linkage: Find patterns where specific behaviors (e.g., attending multiple networking events) correlate with certain types of feedback (e.g., higher satisfaction with networking opportunities).

Crafting Your Narrative: Post-Event Reporting that Resonates

The culmination of your hard work is a compelling, clear post-event report. This isn't just a data dump; it's a narrative that tells the story of your event, proving its value, highlighting key learnings, and paving the way for future success.

Post-Event Reporting Best Practices:

- Start Data Collection Early: As stressed before, integrate data capture mechanisms throughout all event phases – pre-event, during, and post-event. This ensures a comprehensive dataset for your analysis.

- Involve All Stakeholders: Don't work in a silo. Include event planners, marketing teams, sales, sponsors, exhibitors, and even select attendees in review discussions. Their diverse perspectives enrich the analysis and foster shared ownership of improvement plans.

- Maintain Objectivity & Thoroughness: Use standardized metrics, cross-validate data from multiple sources, and ensure you balance quantitative facts with qualitative insights. Avoid subjective interpretations without supporting data.

- Use Visuals, Charts & Clear Formats: Numbers alone can be overwhelming. Employ charts, graphs, infographics, heatmaps, and dashboards. Each visual should have a clear, narrative caption explaining its significance.

- Avoid Common Pitfalls:

- Lack of complete data: Missing crucial information can lead to skewed conclusions.

- Subjective interpretation: Letting personal biases influence the analysis.

- Ignoring stakeholder feedback: Dismissing critical input from key groups.

- Delaying analysis: The longer you wait, the less accurate and relevant the data and memories become.

- Organize Debrief Meetings: Hold internal and, where appropriate, external debriefs soon after the event. These sessions are vital for gathering immediate lessons learned, fostering open discussion, and co-creating improvement plans. These aren't blame sessions; they're learning opportunities.

Design Clear & Impactful Post-Event Reports:

Structure your reports to tell a compelling, easy-to-digest story. Think of it as presenting the highlights reel, backed by robust data.

Key Report Sections:

- Executive Summary: This is paramount. A concise snapshot (1-2 paragraphs) of the event's most critical outcomes, key successes, significant challenges, and top recommendations. This is often the only section busy executives read.

- Event Overview & Objectives: Briefly recap the event's basics (name, dates, target audience) and, critically, reiterate the primary goals set before the event. This sets the stage for evaluating performance against those benchmarks.

- Key Results & Metrics: Present your performance data clearly, aligning it directly with your stated objectives. Use charts and graphs to illustrate attendance figures, engagement rates, satisfaction scores, and other relevant metrics.

- Attendee & Stakeholder Feedback: Summarize survey results, highlight compelling qualitative insights, and outline key trends emerging from comments and interviews. Include impactful quotes where appropriate.

- Financial Summary: A transparent overview of total revenue, a breakdown of expenses (categorized), and the calculated ROI. Explain any significant variances from the budget.

- Lessons Learned & Key Challenges: This is where you address what went well, what didn't meet expectations, any unexpected issues that arose, and—crucially—their root causes. This section should be objective and focused on learning.

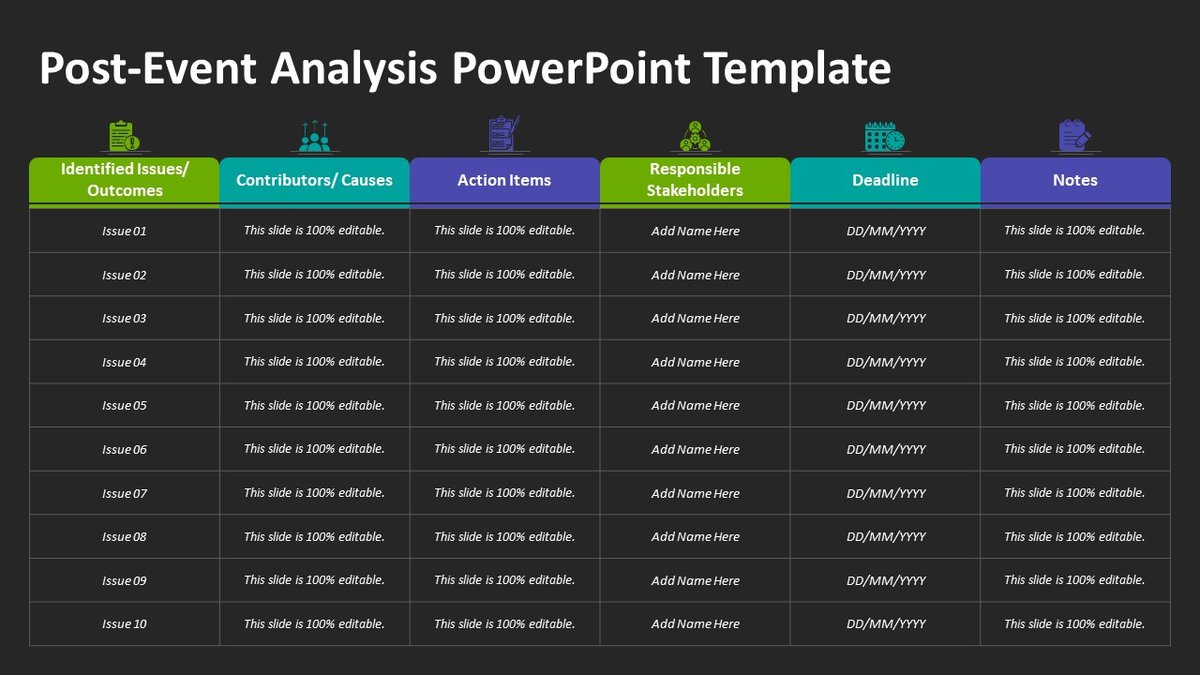

- Actionable Recommendations & Next Steps: This is the payoff. Provide specific, tangible recommendations for improving future events, assign responsibilities, and outline implementation timelines. This transforms insight into a clear path forward.

Presentation Tips:

- Prioritize Clarity and Brevity: Get to the point. Use plain language.

- Use Powerful Visuals: Charts, graphs, and infographics make complex data digestible.

- Create a Narrative Flow: Guide your audience through the event's story, from goals to outcomes to future actions.

- Customize Content for Different Audiences: An executive summary might suffice for leadership, while a detailed report is for the operations team.

- Highlight Impact with Emphasis: Use bolding, callout boxes, or specific formatting to draw attention to your most significant findings and recommendations.

- Incorporate Quotes: Real attendee or sponsor quotes add a human touch and reinforce qualitative findings.

- Prepare for Questions: Anticipate potential questions and have supporting data ready.

Beyond the Report: Activating Your Aftermath for Future Growth

A beautifully designed report sitting unread on a server is a waste of valuable effort. The true power of post-event analysis lies in its activation. This isn't the end of a process; it's the critical starting point for your next, even more successful event.

Your aftermath strategy must culminate in tangible actions:

- Implement Recommendations: Systematically work through your "Actionable Recommendations & Next Steps" list. Assign owners, set deadlines, and track progress. This might involve refining your registration process, altering session formats, or re-evaluating vendor relationships.

- Refine Processes & Documentation: Update your event planning templates, checklists, and internal guidelines based on lessons learned. Document new best practices. This ensures that improvements become institutional knowledge rather than forgotten insights.

- Communicate & Celebrate: Share your findings, not just the challenges but also the successes. Celebrate what went well to boost team morale and recognize contributions. Transparent communication fosters a culture of continuous improvement.

- Set New Benchmarks: Armed with your analysis, you can now set more realistic and ambitious goals for your next event. You have a clearer understanding of your audience, your capabilities, and the market.

- Leverage for Marketing & Sales: Use positive feedback, compelling statistics, and success stories from your analysis in future marketing efforts to attract attendees and sponsors. Showcase your event's proven value.

FAQs: Demystifying Your Post-Event Analysis

How long after an event should I conduct analysis?

Ideally, data collection (surveys, debriefs) should begin immediately after the event concludes, while memories are fresh. The full analysis and reporting process should be completed within 2-4 weeks. Any longer, and the insights lose their immediacy and relevance for future planning.

What if I don't have enough data?

Even a small amount of data is better than none. Start with what you have: registration numbers, basic feedback from a handful of attendees, and your financial summary. For future events, actively implement more robust data collection methods. Small events can still benefit immensely from structured qualitative feedback (interviews, focus groups).

Is qualitative data really as important as quantitative?

Absolutely. Quantitative data tells you what happened (e.g., 60% session attendance), but qualitative data tells you why it happened (e.g., "The session was too long," or "The speaker was incredibly engaging"). Both are essential for a complete picture, providing context and depth that numbers alone cannot offer. Don't underestimate the power of human stories and direct feedback.

The Unseen Advantage: Why Your Aftermath Strategy is Your Next Big Win

In the dynamic world of event planning, the ability to consistently learn and evolve isn't just a nice-to-have; it's a competitive advantage. Your post-event analysis and its subsequent aftermath strategy are what transform an isolated occurrence into a strategic asset. It's how you turn a single event into a stepping stone, each one building on the successes and learnings of the last.

By meticulously analyzing every facet of your event, you're not just looking backward; you're actively building a more intelligent, responsive, and impactful future. You're proving your value, delighting your stakeholders, and ensuring that every event you plan is not just an experience, but a meticulously engineered success. Embrace the aftermath—it's where your next big wins are forged.